-

What Are Financial Apps?

Managing your finances effectively can feel like a constant struggle in today’s fast-paced world. Between bills, savings goals, and unexpected expenses, losing track of your hard-earned money is easy. Personal finance apps have emerged as powerful tools to simplify financial management, offering a convenient and accessible way to take control of your financial well-being. What…

-

What is Personal Finance?

Personal finance is a word that might sound intimidating, but it simply refers to how you manage your money. It embodies everything from earning income and budgeting expenses to saving for goals and investing for the future. Regardless of your income level, personal finance allows you to take full control of your financial well-being and…

-

Retirement Savings Crisis

According to the Bureau of Labor Statistics, the number of US workers over the age of 75 is expected to nearly double over the next decade, creating a looming retirement crisis. With the rising costs of healthcare, housing, and not enough wages, millions of older Americans don’t have enough savings to cover their basic needs…

-

How Budgeting Works

Most people struggle with planning their finances and allocating their resources, which is where budgeting comes in. To achieve financial stability and long-term financial goals your financial planning and budgeting are very important. However some may struggle with this due to various reasons ranging from financial illiteracy to unexpected expenses, so it is essential to…

-

Understanding Budgetary Finance

Taking control of your finances can feel overwhelming. But by implementing smart budgetary practices, you can transform your financial well-being and achieve your long-term goals. This guide updates you with the knowledge and tools to sail budgetary financial planning, empowering you to make informed financial decisions. Budgetary Planning. A budget is a roadmap for your…

-

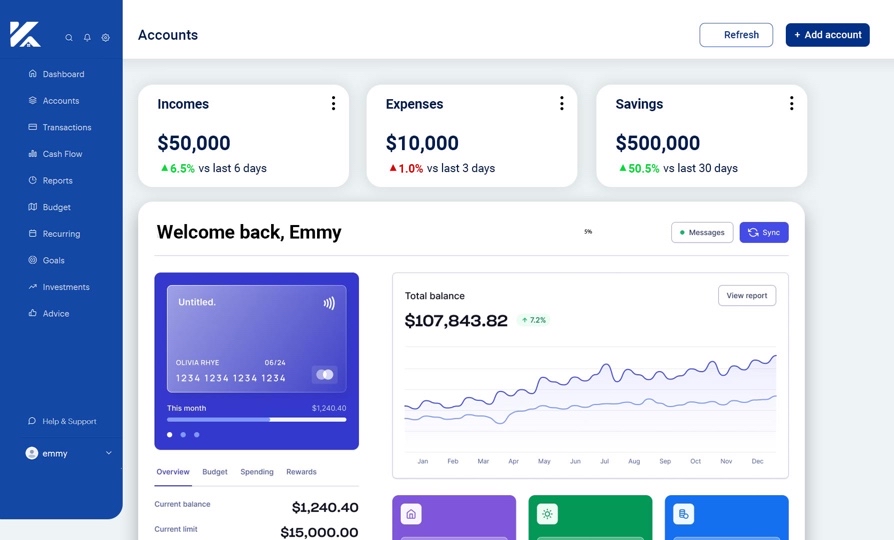

WHY ARE BUDGETING APPS SO IMPORTANT?

The struggle is real. Between managing everyday expenses, juggling unexpected costs, and saving for future goals, keeping your finances in order can be very overwhelming and almost impossible to stabilize. But what if there was a more programmed way, a tool that simplifies budgeting, automates savings, and empowers you to take control of your financial…

-

what net worth means

Net worth is a term frequently used around in financial conversations, yet sometimes we don`t know the depth of the word. Beyond our assumptions and speculations, This article tells us more about the concept of net worth, its importance in financial planning, and effective strategies to build and monitor it. At its essence, net worth…

-

Investment and Returns

To know that your finances are growing, your investment and its returns are the key factors to look out for. Understanding how investments and returns are impacting your financial goals is important for assessing the performance of investments and making the best financial decisions. To maximize potential returns, it’s important to diversify your investments across…

-

WHO ARE FINANCIAL PLANNERS? AND WHAT DO THEY DO?

Ever felt overwhelmed by the complex world of finance? You’re not alone. This is where financial planners come in – Finacial planners are people who help you sail the journey of your financial journey without you having to be in control of the ship. Isn`t that a sweet gesture? Now let`s talk about what Financial…

-

Credit Management System

Credit management is the process of controlling credit granted to customers. It involves continually evaluating customer’s creditworthiness, setting credit limits, monitoring payments and collections, and taking steps to ensure timely repayment. Credit which refers to a person obtaining goods or services with delayed payment, gives customers more flexibility. Effective credit management helps businesses to minimize…