What Are Financial Apps?

Managing your finances effectively can feel like a constant struggle in today’s fast-paced world. Between bills, savings goals, and unexpected expenses, losing track of your hard-earned money is easy. Personal finance apps have emerged as powerful tools to simplify financial management, offering a convenient and accessible way to take control of your financial well-being.

What Exactly Are Financial Apps?

Financial apps are software applications designed to help you manage your money efficiently. These apps, which are downloadable on smartphones and tablets, provide a range of functionalities, including:

- Budgeting: Set and track spending limits across different categories like groceries, entertainment, and bills.

- Expense Tracking: Categorize and monitor your income and outflows, clearly showing your spending habits.

- Bill Pay: Schedule and automate bill payments, ensuring you never miss a due date and avoid late fees.

- Financial Goal Setting: Define financial objectives like saving for a down payment or a dream vacation, and track your progress towards them.

- Investment Tracking: Monitor your investment portfolio’s performance and stay informed about market fluctuations.

- Debt Management: Create a debt repayment plan and track your progress toward becoming debt-free.

- Financial Literacy Tools: Access educational resources and tips that help improve your financial knowledge and also help maintain your financial health.

Why Use a Financial App?

The benefits of using a Financial app are numerous. Here’s how these apps can empower you to achieve your financial goals:

- Gaining Financial Clarity: Financial apps provide a consolidated view of your income, expenses, and financial commitments. This transparency allows you to make informed financial decisions and identify areas where you can optimize your spending.

- Effortless Budgeting: Budgeting can be tedious, but personal finance apps automate the process. You can set spending limits and track your progress effortlessly, ensuring you stay on track with your financial goals.

- Saving Time and Money: Missed bill payments and late fees can drain your finances. Personal finance apps help you schedule and automate payments, saving you time and money.

- Reaching Financial Goals Faster: Visualizing progress toward financial goals can be a powerful motivator. Personal finance apps allow you to track your progress, keeping you focused and motivated to achieve your financial aspirations.

- Building Healthy Financial Habits: Using a personal finance app consistently promotes responsible financial behavior. By tracking your spending and setting goals, you’ll develop positive financial habits that empower you to make informed financial decisions in the long run.

Choosing the Right Financial App for You

With a vast array of Financial apps available, selecting the one that perfectly suits your needs can be overwhelming. Here are some key factors to consider when making your choice:

- Features Offered: Identify the functionalities that are most important to you. Do you prioritize budgeting tools, bill pay features, or investment tracking? Choose an app that offers the features you’ll use most frequently.

- Security: Since personal finance apps handle sensitive financial data, prioritize apps with robust security measures like multi-factor authentication and data encryption.

- Budget: Many Financial apps offer free basic features, with premium features available through subscriptions. Consider your needs and budget to find an app that provides the value you seek.

- Ease of Use: A user-friendly interface is crucial. Choose an app with intuitive navigation and clear visuals to ensure a smooth and enjoyable user experience.

- Compatibility: Ensure the app is compatible with your smartphone or tablet’s operating system (iOS, Android, etc.).

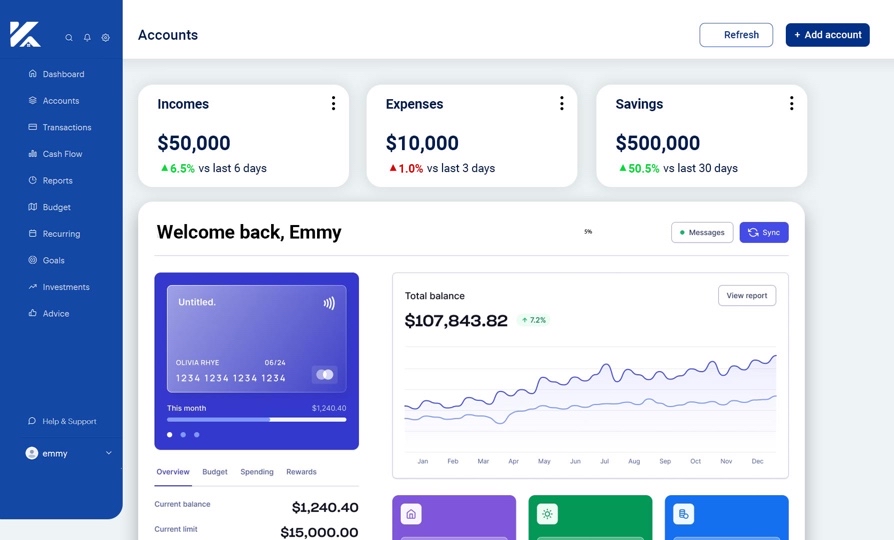

Financial App Recommendation.

Kribsavup is a Financial app that can help you have a great financial journey. Here are some of its unique features;

- Creating a budget: Whether you’re trying to buy a house, gift your loved ones, go on a luxurious shopping trip, or even give yourself some self-care treatment. Kribsavup budgeting tools allow you to create a budget that fits your goals. And even better, you can use the auto budget plan or create your own.

- Net worth building: With the Kribsavup APP, you can put away funds for your major purchases like buying dream-long apartments or investing in real Estate. However, Real Estate is one of the keys to building massive wealth and that alone can help boost the most of your net worth. You deserve to own your own home and also be at a great advantage with your Real Estate Investment which will bring you enormous benefits always.

- Credit Reporting: You will have options to choose either a single bureau report or a Tri-merged credit report Receive real-time alerts when your credit is accessed. The Kribsavup app also helps you monitor your card at all times. Also, you get ready access to Identity Theft Restoration services, our features are wholly for your security.

Building Financial Wellness.

Personal finance apps are powerful tools, but they’re just one piece of the financial wellness puzzle. Here are some additional tips to complement your app usage and achieve long-term financial success:

- Develop a Financial Plan: Having a clear strategy for your money is crucial. Outline your financial goals, both short-term and long-term, and identify the steps needed to achieve them.

- Embrace Financial Education: Continuously seek knowledge to improve your financial literacy. Read personal finance books, articles, and blogs to stay informed about investment strategies, debt management techniques, and the ever-evolving financial landscape.

- Seek Professional Guidance: Financial advisors can offer personalized advice and guidance tailored to your specific financial situation. Consider consulting a professional for complex financial decisions or if you require in-depth financial planning assistance.

Financial apps are a game-changer in the world of financial management and by leveraging their features and functionalities, you can gain control of your finances, make informed decisions, and achieve your financial goals with greater ease and confidence.

Remember, personal finance is a journey, not a destination.